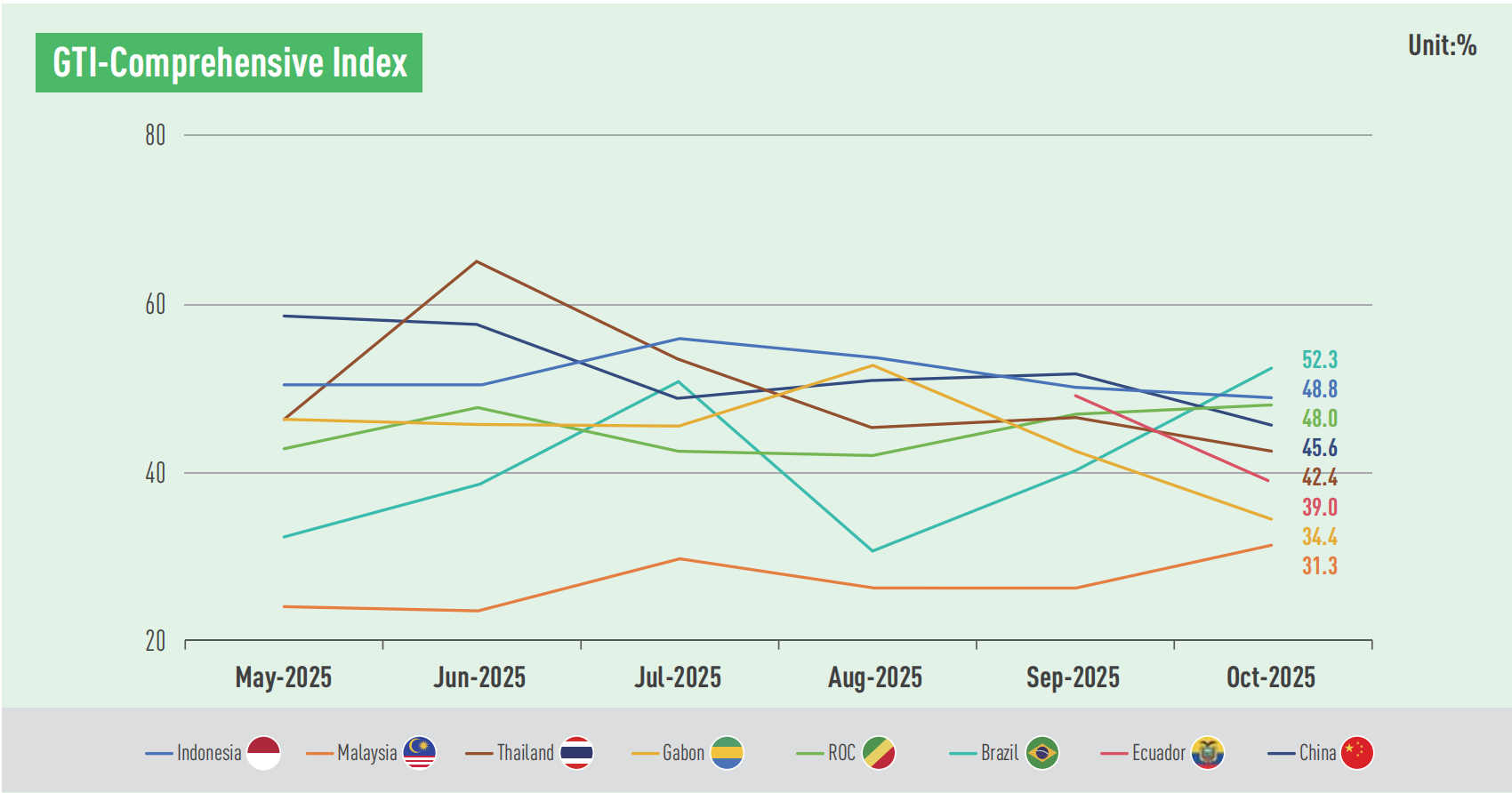

In October 2025, the Global Timber Index (GTI) report indicated that most pilot countries remained in contraction territory, pointing to weak overall industry sentiment. Brazil stood out this month as the only country with a GTI reading above the 50% mark, registering 52.3%, signaling an overall expansion in its timber industry production and business activities. In China, influenced by the National Day holiday, enterprise production and operational activities slowed, with the GTI-China index recording 45.6%. The GTI indices for Indonesia, Congo, Thailand, Ecuador, Gabon, and Malaysia all remained below the 50% threshold, registering 48.8%, 48.0%, 42.4%, 39.0%, 34.4%, and 31.3% respectively.

Despite the prevailing contraction in most countries' timber sectors, some sub-indices released positive signals. For instance, the harvest volume of GTI sample enterprises in Indonesia had grown for several consecutive months. In Malaysia, the production side halted a streak of significant declines seen over previous months. Congo experienced growth in its domestic market. Additionally, Brazil's export orders saw growth for the first time in the recent ten months, with a notable increase compared to the previous month.

Feedback from GTI sample enterprises highlighted common challenges related to raw materials and market demand faced by the timber industry in multiple countries. Regarding raw materials, several enterprises in Thailand reported a domestic shortage of rubberwood, making it difficult to procure. Heavy rainfall in countries like Indonesia, Brazil, and Ecuador adversely impacted logging operations and log transportation within their timber industries.

Concerning market demand, GTI sample enterprises in both Brazil and Ecuador mentioned contraction in the US market. Latest industry information also shows that US tariff policies are prompting many countries to pivot towards new markets. Taking the furniture industry as an example, Chinese furniture exports to North America saw a continued decline in the first three quarters of 2025, while markets in Europe, Latin America, and Africa saw positive growth. In Brazil, the impact of tariffs was particularly felt in states like Santa Catarina, São Paulo, and Minas Gerais, which have begun shifting their focus towards markets in Latin America, Europe, and the Middle East. Furthermore, the Malaysian government, by assisting local enterprises in exploring new markets such as the Middle East and Africa, has successfully generated approximately RM 205 million in export value.

Main progresses in sustainable forest management include: As of October 2025, Indonesia has 574 Forest Utilization Business Permit (PBPH) units, covering approximately 30 million hectares of production forest. On 22 October, Gabonese Agency for Space Studies and Observations (AGEOS) and China's Land Satellite Remote Sensing Application Center (LASAC) under the Ministry of Natural Resources, signed a Memorandum of Understanding (MoU). By granting Gabon privileged access to China's high-resolution satellite imagery, the MoU aims to enhance Gabon's capabilities in forest protection and combating illegal exploitation of natural resources. In other news, a World Bank report titled "Congo Basin Forest Ecosystem Accounts and Policy Recommendations," released on 20 October, stated that countries including the Congo have made progress by embedding forest sustainability into national planning.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|