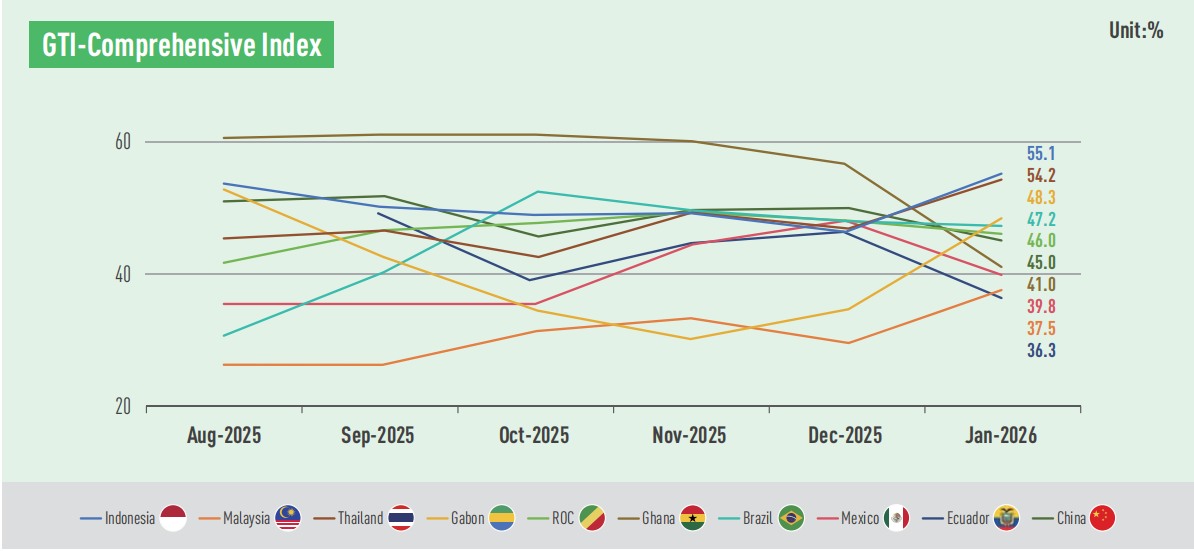

The Global Timber Index (GTI) Report for January 2026 revealed that two of the ten pilot countries—Indonesia and Thailand—posted GTI readings above the 50% critical value, registering 55.1% and 54.2%, respectively. In contrast, the other eight countries stayed in contraction territory: Gabon (48.3%), Brazil (47.2%), the Republic of the Congo (46.0%), China (45.0%), Ghana (41.0%), Mexico (39.8%), Malaysia (37.5%), and Ecuador (36.3%).

GTI sub-indexes pointed to several encouraging regional developments. In Southeast Asia, domestic markets improved in both Indonesia and Thailand, where the production volume also increased. In Africa, the supply side showed signs of stability, as harvesting and production activities in Gabon and the Republic of the Congo held steady. In Latin America, the bright spot was export performance, evidenced by month-on-month increases in the export volume of both Brazil and Mexico, while Ecuador’s export market stabilized after earlier declines. Together, these developments emerged as the regional highlights for the timber sector in January.

Nevertheless, feedback from GTI sample enterprises indicated that raw material shortages and persistently high production costs remained common challenges confronting the timber sectors in some countries. Enterprises in Indonesia, Thailand, Brazil, and Ecuador reported insufficient or unstable raw material supplies, while sample enterprises in Malaysia, Ghana, and China pointed to rising or persistently high purchase prices for raw materials. In addition, businesses were facing cost pressures in areas such as labor, electricity, fuel, and taxation. In response, some enterprises suggested stronger cost controls and called for government support through subsidies, tax incentives, and other policies.

Looking back over the past year, some countries managed to achieve export growth despite challenging external conditions. For example, Thailand’s exports of furniture and parts reached around US$1.80 billion in 2025, up 23.81% year-on-year. Brazil’s exports of lumber rebounded after three consecutive years of decline, climbing 5% to 2.96 million cubic meters in 2025; although shipments to the United States fell 12% to 842,000 cubic meters, exports to China, Spain, the United Arab Emirates, Saudi Arabia, and some other markets registered increases.

At the start of the new year, GTI pilot countries had made new progress in addressing industry challenges and stimulating demand. On the supply side, the Union of Foresters and Wood Industries of Gabon (UFIGA) and the railway operating company SETRAG reached an agreement on January 7, removing the requirement for cash payment prior to transportation—a move that would effectively ease cash flow pressures on forestry operators. On the demand side, several countries had introduced new housing policies and targets that are expected to provide a tailwind for timber and furniture demand. In Brazil, the government had set a new target for its “Minha Casa, Minha Vida” affordable housing program, aiming to contract 1 million new homes in 2026; the Mexican government raised its housing targets under the Housing Program for Wellbeing; and Ecuador had significantly reduced the mortgage interest rate for first-time homebuyers from 4.99% to 2.99%; and China had positioned the construction of “good houses” as a key priority in its 2026 work framework, adopting city-specific approaches to control incremental supply, reduce existing inventory, and optimize housing supply, while strongly advancing smart construction and green construction to promote high-quality development of the real estate sector.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|