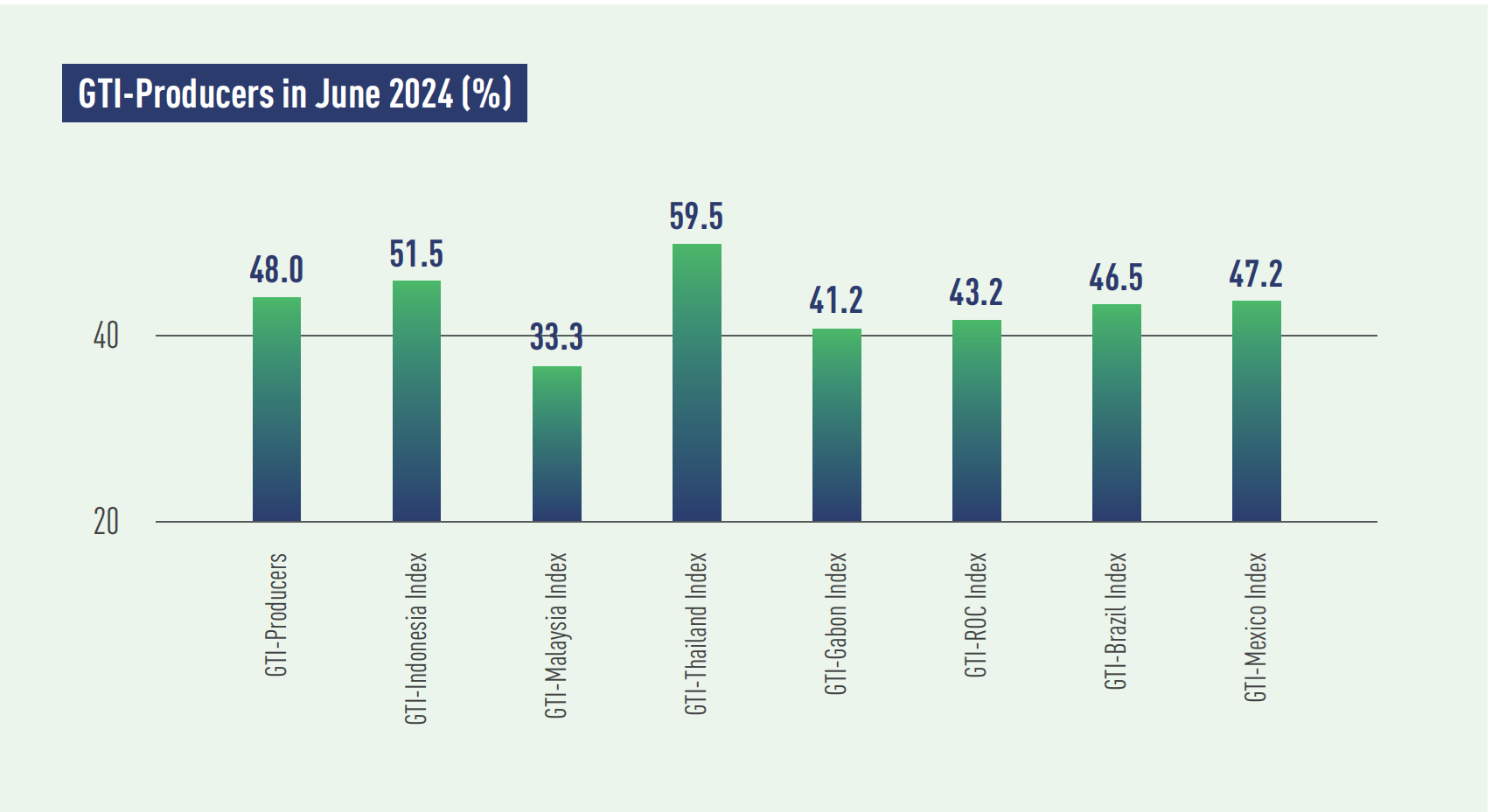

In June 2024, the GTI-Producers registered 48.0% and had stayed below the critical value (50%) for two consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Encouragingly, the index rose 8.8 percentage points over the previous month, indicating the overall contraction had eased, primarily due to market recovery in Thailand and Indonesia, and less contraction in other producing countries.

In Asia, the GTI indexes for Thailand and Indonesia stood above the critical value (indicating expansion) and registered 59.5% and 51.5%, respectively, while the GTI index for Malaysia was at 33.3% in the contraction range. Specifically, both Thailand and Indonesia saw a significant increase in the respective volume of harvesting, production and orders, signaling month-over-month improvements on both supply and demand sides. Harvesting in Malaysia contracted for three consecutive months, partly due to the government's control of timber harvesting for sustainable forest management, for example, the Sarawak state government had reduced the state's logging rate by about two million cubic meters annually. In terms of raw material prices, the GTI-Indonesia enterprises reported log prices in the country were still relatively low, while GTI-Thailand and GTI-Malaysia enterprises reported rising prices or high costs of raw materials, and in the face of material problems, they hoped to expand external channels for sourcing raw materials or find more reliable material distributors.

In Africa, the GTI indexes for Gabon and the Republic of the Congo (ROC) were at 41.2% and 43.2%, respectively, both in the contraction range below the critical value, and the harvesting volume in both countries remained largely unchanged from the previous month. In the Republic of the Congo, the volume of orders decreased in the domestic market while the volume was relatively stable in the international market, and the volume of production was basically the same as the level in the previous month. In Gabon, the timber sector was facing challenges from infrastructure that restricted timber production and transportation, in response to which the government was intensifying its efforts to enhance the construction and maintenance of roads and other infrastructure, and on the demand side, the domestic and foreign demand for the country's timber sector was insufficient, and some enterprises reported a slowdown in the markets of Asia and Europe, as a result, connecting with the demand side had become the most urgent issue.

In Latin America, the GTI indexes for Brazil and Mexico registered 46.5% and 47.2%, respectively, both in the contraction range below the critical value. The volume of timber harvesting was still contracting in both countries, partly due to extreme weather conditions which had delayed the recovery of logging activities. On the production side, timber production in Brazil resumed growth, and in Mexico, the decline in the production slowed down. On the demand side in Brazil, the performance of exports was relatively stable when compare to the previous month, but there was a decline in domestic timber trading, while in Mexico, the enterprise had enhanced their ability to secure domestic orders, however, the volume of orders from the international market continued to decline.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|