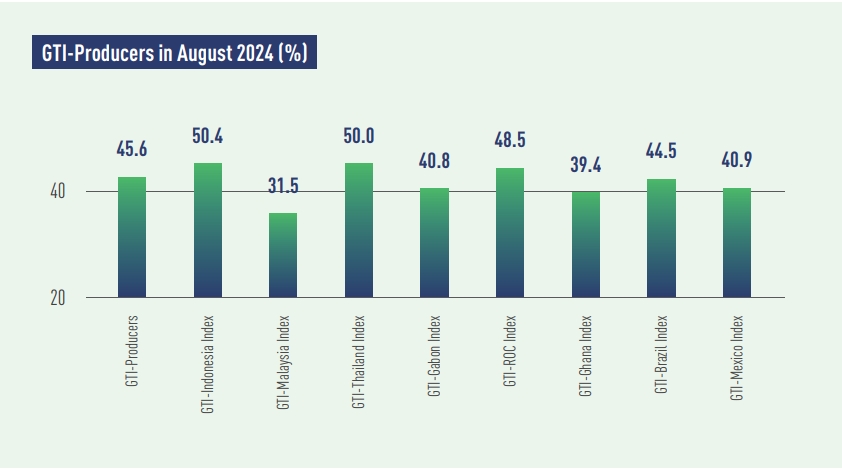

In August 2024, the GTI-Producers registered 45.6% and had stayed below the critical value (50%) for four consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Specifically, the timber sector in both Indonesia and Thailand was relatively stable compared to the previous month, while sluggish performance was observed in other countries.

In Asia, the GTI indexes for Indonesia and Thailand rose to 50.4% and 50.0%, respectively, slightly exceeding or reaching the critical value, indicating that the overall performance of the timber sector in both countries held steady. The GTI index for Malaysia registered 31.5%, still in the contraction range below the critical value, however, the contraction had slowed down. Compared to the previous month, GTI-Indonesia sample enterprises saw a significant increase in timber harvesting, production volume, and export orders. GTI-Thailand sample enterprises also reported a large increase in timber harvesting and new orders. The timber market in Malaysia was not active in terms of supply and demand, with some sample enterprises reporting that production and transportation volumes were approaching saturation, and there was a lack of consumer demand in the timber market.

In Africa, the GTI indexes for the Republic of the Congo (ROC), Gabon, and Ghana were at 48.5%, 40.8%, and 39.4%, respectively, all in the contraction range below the critical value. Compared to the previous month, the harvesting volume increased in Gabon, held steady in ROC, and decreased significantly in Ghana. On the demand side, the volume of orders for GTI sample enterprises in all the three countries decreased compared to the previous month, so the enterprises were seeking to expand into markets such as Asia and the Middle East, and wanted to enhance communications with international clients. In the meantime, they were also hoping for support from the government in the form of tax reductions and enhanced marketing efforts for the timber sector.

In Latin America, the GTI indexes for Brazil and Mexico registered 44.5% and 40.9%, respectively, both in the contraction range below the critical value, however, the contraction had narrowed. The exchange rate of the US dollar against the Brazilian real had not yet stabilized, which had a certain negative impact on the sales opportunities in Brazilian domestic market. However, the number of existing orders held by GTI-Brazil sample enterprises increased compared to the previous month, providing momentum for following production. As to the timber sector in Mexico, the production activities of enterprises had also slowed down at the time when the country was experiencing government change.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|