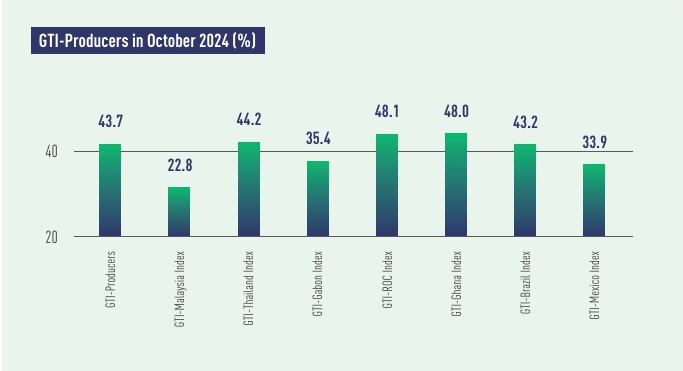

In October 2024, the GTI-Producers registered 43.7% and had stayed below the critical value (50%) for six consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries.

In Asia, the GTI indexes for Thailand and Malaysia registered 44.2% and 22.8%, respectively, both in the contraction range below the critical value. In Thailand, the volume of timber harvesting declined for two consecutive months, the production remained relatively stable, while the volume of new orders slightly decreased. In Malaysia, both supply and demand sides of the timber sector were contracting, and in particular, the volume of harvesting had been decreasing significantly for three consecutive months, due to weak domestic and international demand, and unfavorable weather. In addition, the Malaysian government has imposed restrictions on harvesting in order to fulfill its commitment to forest conservation, which also contributed to the decline in harvesting.

In Africa, the GTI indexes for the Republic of the Congo (ROC), Ghana, and Gabon were at 48.1%, 48.0%, and 35.4%, respectively, all in the contraction range below the critical value, however, the contraction in the timber markets of the three countries had all eased. In Ghana, there was a slight decline in harvesting, production, and orders. In Gabon and ROC, the volume of harvesting had decreased for two consecutive months, however, the production volume held steady when compared to the previous month. On the demand side, ROC’s export performance was relatively stable, while the domestic market contracted slightly. As to Gabon, both domestic and international demand had been declining for several months. Due to insufficient demand in the global timber market, rising raw material prices, and limitations in local logistics facilities, African enterprises still faced significant operation and production pressures.

In Latin America, the GTI indexes for Brazil and Mexico registered 43.2% and 33.9%, respectively, both in the contraction range below the critical value. The timber sector in both countries saw a decline in harvesting, production, and orders, when compared to the previous month. The main reason is unfavorable weather affected the efficiency of harvesting, and insufficient market demand resulted in reduced orders and a slowdown in enterprises’ production. Additionally, the timber sector in both countries faced logistics challenges. For example, GTI-Brazil enterprises reported slow export clearance and high maritime freight costs. And in Mexico, the increase in traffic had strained capacity at seafreight gateways and pushed average import container dwell time to 11 days, well beyond the seven-day grace period before storage charges kick in.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|