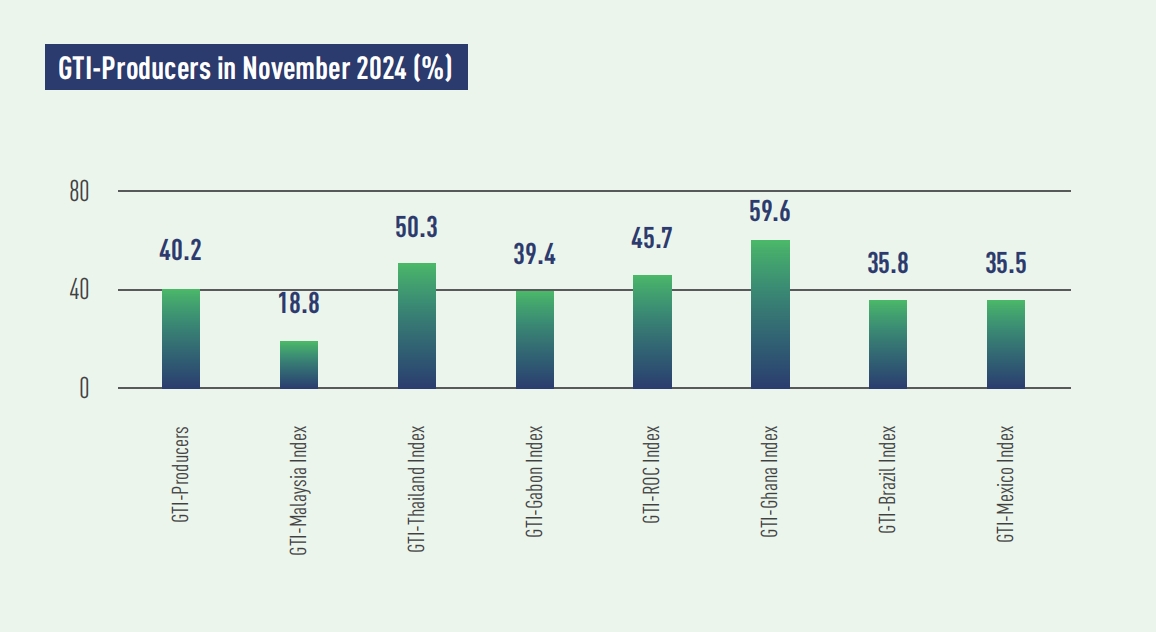

In November 2024, the GTI-Producers registered 40.2% and had stayed below the critical value (50%) for seven consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. This month, the timber sectors in Thailand and Ghana showed signs of recovery compared to the previous month, while other countries were still affected by weak demand in the timber markets, with their indexes remaining in the contraction range.

In Asia, the GTI indexes for Thailand and Malaysia registered 50.3% and 18.8%, respectively. Thailand's timber sector showed an upward trend after two months of decline, while Malaysia's timber sector remained relatively sluggish. Due to the traditional rainy season, the volumes of harvesting and production in Malaysia decreased significantly. However, in Thailand, despite severe flooding in many parts of the country, the harvesting volume held steady, and the overall production volume increased compared to the previous month. On the demand side, the volume of new orders for Malaysia, both domestically and internationally, continued to decline, while Thailand saw an increase in new orders, particularly from the export market.

In Africa, the GTI indexes for Ghana, the Republic of the Congo (ROC), and Gabon were at 59.6%, 45.7%, and 39.4%, respectively. Ghana's timber sector showed signs of recovery after a four-month downturn. Both harvesting and production volumes in the country increased compared to the previous month, and there was a recovery in demand. However, the continuous rise in the purchase prices of raw materials over several months indicates persistent cost pressures for production enterprises. In ROC, the timber sector contracted slightly this month, due to a lack of effective demand. However, the supply side in the country was relatively stable, with both harvesting and production volumes remaining on par with the previous month’s performance. In Gabon, the timber sector remained largely in a state of contraction, although the degree of contraction had eased slightly.

In Latin America, the GTI indexes for Brazil and Mexico registered 35.8% and 35.5%, respectively, both in the contraction range below the critical value. In Brazil, the volume of harvesting continued to decrease due to persistent rainfall, and there were no signs of recovery in production and orders amidst a contracting market. In the meantime, challenges such as low cargo handling efficiency at the ports, labor shortages, and slow administrative procedures also limited the logistics efficiency of products. In Mexico, the downward trend in timber harvesting and production continued, and the demand was still on the decline, especially in the export market, where the downturn was significant. And some companies in the country suggested that the government increase import restrictions and encourage consumers to prioritize local products.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|