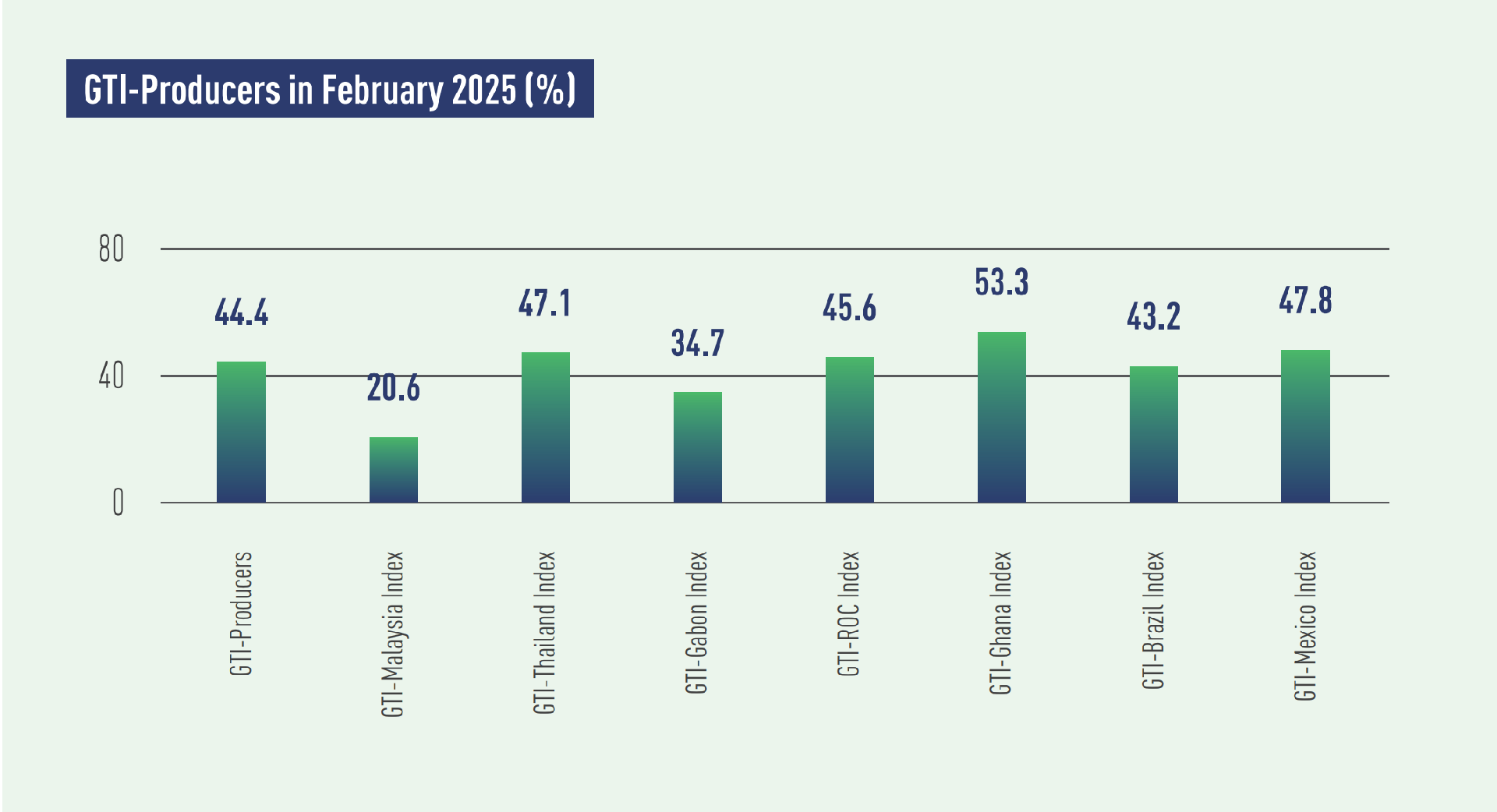

In February 2025, the GTI-Producers registered 44.4% and had stayed below the critical value (50%) for ten consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. However, the index rose 4.6 percentage points over the previous month, indicating the overall contraction had eased. By country, Ghana's timber sector continued to show an upward trend, while the GTI comprehensive indexes for other countries were in the contraction territory. Nevertheless, the downward trends in most timber-producing countries eased.

In Asia, the GTIs for Thailand and Malaysia registered 47.1% and 20.6%, respectively, both in the contraction territory. On the supply side, Malaysia's harvesting and production continued to declined, with many enterprises reporting insufficient log supply. Thailand's harvesting volume held steady, while production volume continued to grow. However, the inventory of raw materials had been declining for 13 consecutive months, and companies were facing pressure from both shortage of raw materials and rising procurement costs. On the demand side, Malaysia’s new orders continued to decrease, and the domestic timber market remained sluggish. The export market also faced challenges due to reduced demand for products like plywood and rising shipping costs, increasing pressure on the timber enterprises. In Thailand, the timber export market saw a decline after three months of growth, but domestic orders increased significantly, keeping the total volume of new orders roughly unchanged from the previous month.

In Africa, the GTI indexes for Ghana, the Republic of the Congo (ROC), and Gabon were at 53.3%, 45.6%, and 34.7%, respectively. Ghana's timber sector showed positive growth for the second consecutive month, while the indexes for ROC and Gabon remained in the contraction territory. This month, harvesting volumes in all the three countries continued to decline. On the production side, Ghana's production volume remained steady compared to the previous month, while ROC and Gabon experienced further declines in production. Timber enterprises in the three African countries still faced various challenges related to factors of production. For example, enterprises in Ghana reported high costs of electricity, water, and raw materials, while those in ROC reported insufficient fuel supply. On the demand side, export orders decreased for all the three countries, partly due to reduced market demand from major consumers such as China, which was affected by the holiday season. Despite these challenges, there were initial positive signs on the demand side this month. For example, ROC’s domestic orders increased, and Ghana's existing orders was sufficient to sustain short-term production and business activities.

In Latin America, the GTI indexes for Mexico and Brazil registered 47.8% and 43.2%, respectively, both in the contraction territory. However, the significant increase in both indexes suggested a notable easing in the downward trends. This month, timber harvesting volumes in both countries declined significantly due to weather conditions and other factors, and in the meantime, production volumes decreased slightly, reflecting weak supply in both countries' timber sectors. According to the GTI-Brazil Focal Point and sample enterprises, while raw material supply for production in Brazil was unstable, the supply of pine and eucalyptus logs was stable. On the demand Side, Mexico’s export market remained stable for the third consecutive month, while the domestic market was active this month. Besides, the Mexican government announced a plan to build more than 50,000 homes from February to April, which is expected to boost timber demand from the construction sector. In contrast, Brazil’s domestic and international timber markets remained sluggish for the second consecutive month. And sample enterprises in the country indicated that Mexican and US markets shrank due to political instability.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|