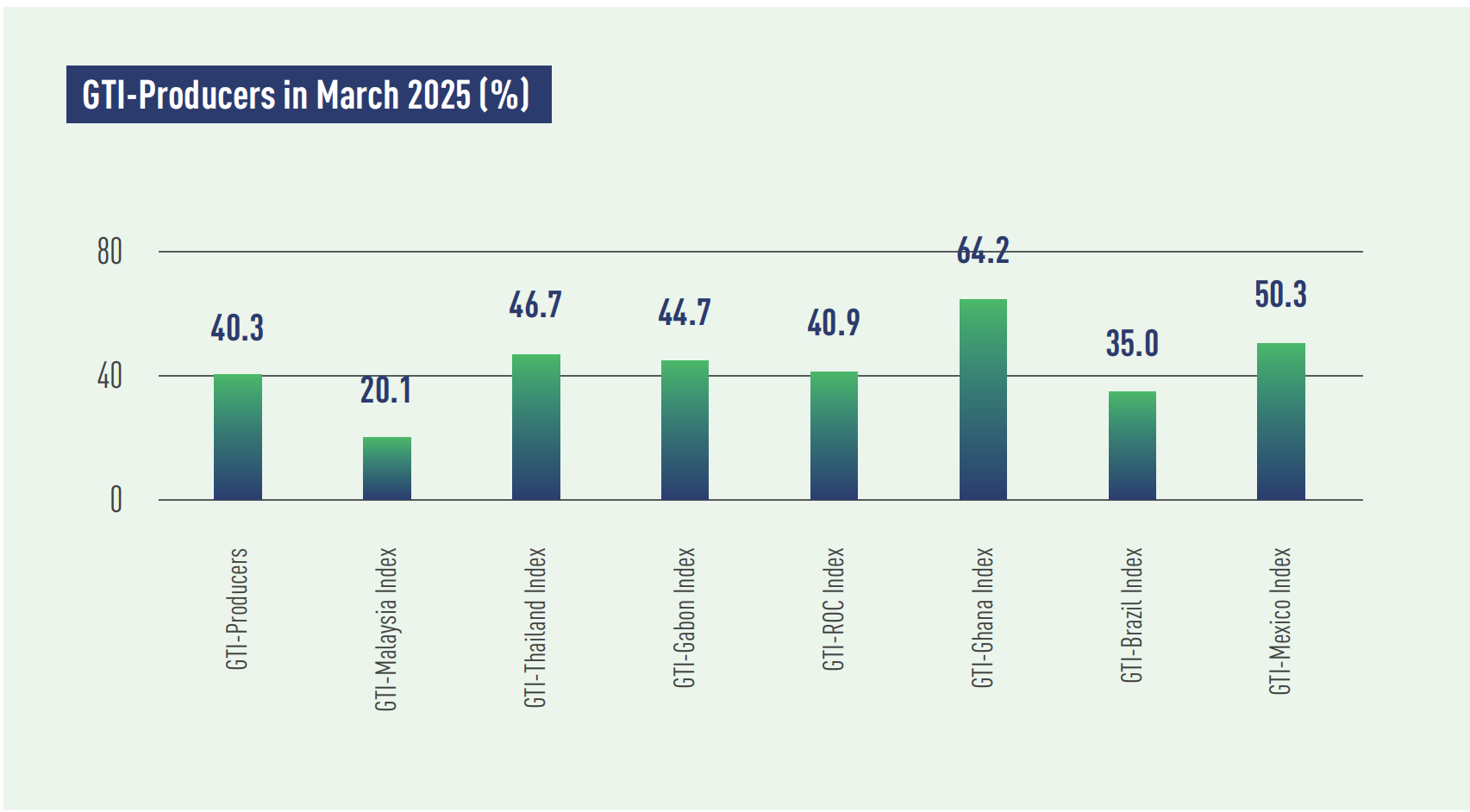

In March 2025, the GTI-Producers registered 40.3% and had stayed below the critical value (50%) for eleven consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. By country, timber sectors in both Ghana and Mexico showed an upward trend, while the sectors in other countries continued to face many challenges, keeping their indexes still in the contraction territory.

In Asia, the GTIs for Thailand and Malaysia registered 46.7% and 20.1%, respectively, still in the contraction territory. On the supply side, Malaysia's timber harvesting and production volumes were still declining, and enterprises reported a lack of logs. In Thailand, timber harvesting and production was stable compared to the previous month, however, some GTI sample enterprises reported shortages of certain materials, such as grade c rubberwood. On the demand side, Malaysia saw a continued decline in new orders, as a result, enterprises were under significant pressure and hoped for government intervention to stimulate demand. Thailand's timber export market was relatively stable, and domestic demand showed growth due to factors such as accelerated infrastructure construction and new real estate policies that boosted the market.

In Africa, the GTI index for Ghana registered 64.2%, remaining in the expansion territory for the third consecutive month, indicating a continuous improvement in the country's timber sector. The GTI indexes for Gabon and the Republic of the Congo (ROC) were at 44.7% and 40.9%, respectively, still in the contraction territory. On the supply side, Ghana had been facing a shortage of raw material supply. This month, timber harvesting in the country showed slight growth and production volume increased significantly compared to the previous month, suggesting a relatively active supply-side performance. In Gabon, timber harvesting and production had declined for five consecutive months, signaling a downward trend on the supply side. In ROC, the volume of harvesting continued to decline slightly while the volume of production held steady. On the demand side, all the three countries saw a reduction in both domestic and foreign orders, however, the contraction in their export market had eased.

In Latin America, the GTI index for Mexico registered 50.3%, the first time in many months that it had risen above the critical value (50%), indicating slight improvement in the country's timber sector. The GTI for Brazil was at 35.0%, still in the contraction territory below the critical value. This month, Mexico's timber harvesting and production increased compared to the previous month, while the supply side of Brazil's timber sector continued to show a downward trend. On the demand side, Mexico's export market contracted, but the total volume of new orders maintained growth due to strong domestic demand. In contrast, Brazil's timber market remained sluggish, especially the export market, which saw a significant decrease compared to the previous month. According to GTI-Brazil enterprises, the rise in US tariff and anti-dumping investigations in Europe had posed challenges for exporters.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|