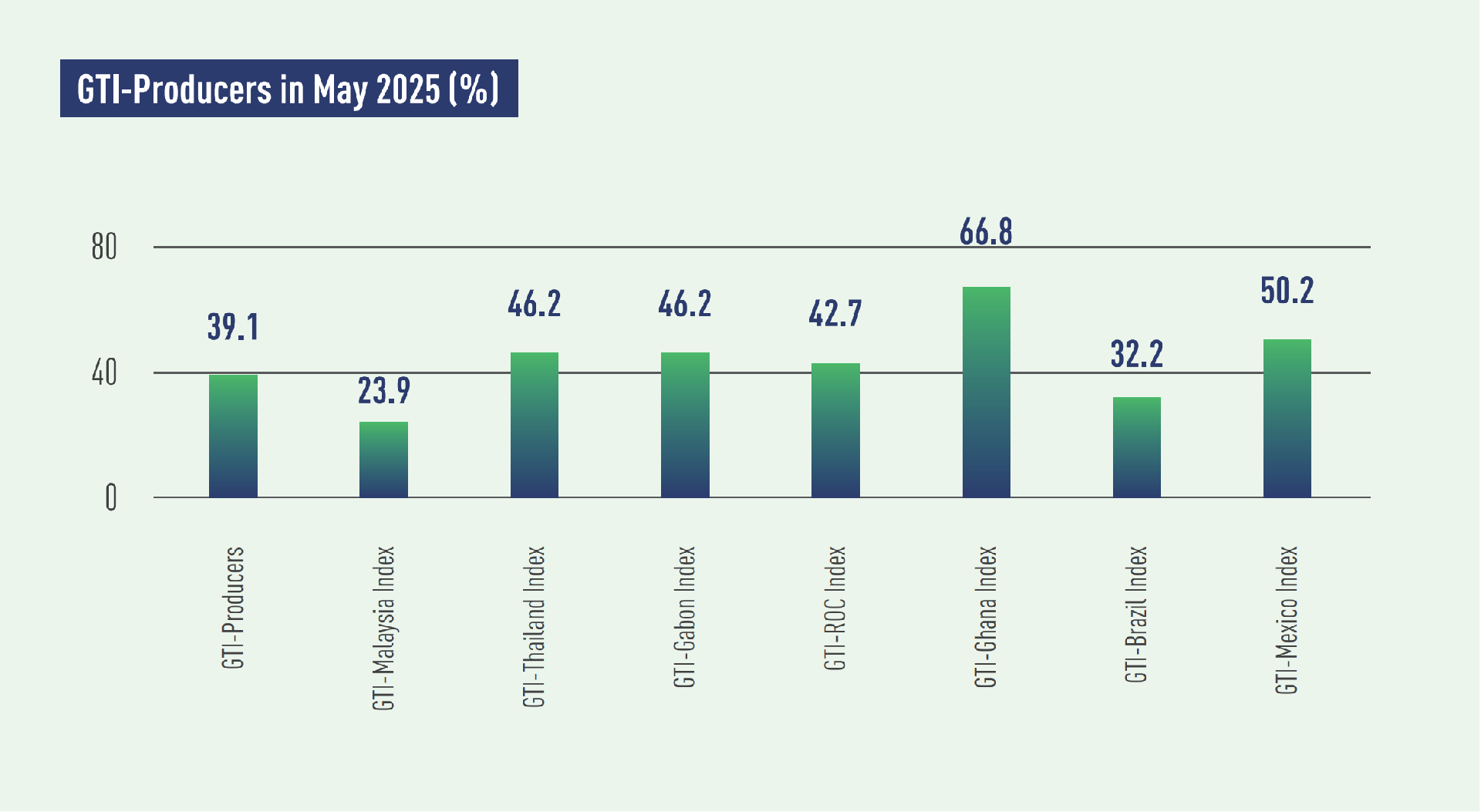

In May 2025, the GTI-Producers registered 39.1%, unchanged from the previous month and staying below the critical value (50%) for 13 consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. By country, timber sectors in both Ghana and Mexico maintained an upward trend for several consecutive months, while the GTI comprehensive indexes for other countries were still in the contraction territory.

In Asia, the GTIs for Thailand and Malaysia registered 46.2% and 23.9%, respectively, still in the contraction territory. On the supply side, Malaysia's harvesting volume, production volume, and inventory of main raw materials continued to decline sharply, with many enterprises still facing significant shortage of raw materials. In Thailand, the harvesting volume had decreased for two consecutive months, although production had stabilized. And as the country officially began its rainy season on 15 May, which may somewhat impact harvesting, it is suggested that manufacturers implement dynamic inventory management. On the demand side, Malaysia saw a continued decline in its new orders, and sample enterprises in the country suggested more effective marketing and hoped for government intervention to stimulate demand. In Thailand, the domestic market demand increased, while overseas market held steady. And some businesses said US tariff policies posed challenges, hoping the government could accelerate trade negotiations and reach a conclusion for a clearer direction.

In Africa, the GTI indexes for Ghana, Gabon, and the Republic of the Congo (ROC) registered 66.8%, 46.2%, and 42.7%, respectively. Ghana's timber sector continued to show an overall upward trend, with its GTI staying above the 50% critical value for five consecutive months, while the indexes for ROC and Gabon remained in the contraction territory. On the supply side, Ghana’s timber harvesting and production volumes continued to grow this month; in Gabon, the production volume increased, though harvesting volume continued to decline; in ROC, harvesting and production were still on a downward trend, and some sample enterprises reported low field operation and production efficiency due to rains. On the demand side, the number of new orders for Ghana continued to rise, while orders for both Gabon and ROC decreased, however, their market contraction had eased.

In Latin America, the GTI indexes for Mexico and Brazil stood at 50.2% and 32.2%, respectively. The GTI for Mexico remained above the critical value for three consecutive months, while the index for Brazil was still in the contraction territory. This month, Mexico saw a three-month increase in both harvesting and production, while those activities in Brazil remained sluggish. On the demand side, Mexico's export market shifted from contraction to stability, but domestic demand turned from continuous expansion to contraction. Meanwhile, Brazil’s domestic and international timber markets remained sluggish, and GTI sample enterprises in the country reported challenges from U.S. taxation and European anti-dumping tariffs, suggesting exploring new markets and reduce reliance on the U.S. market.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|