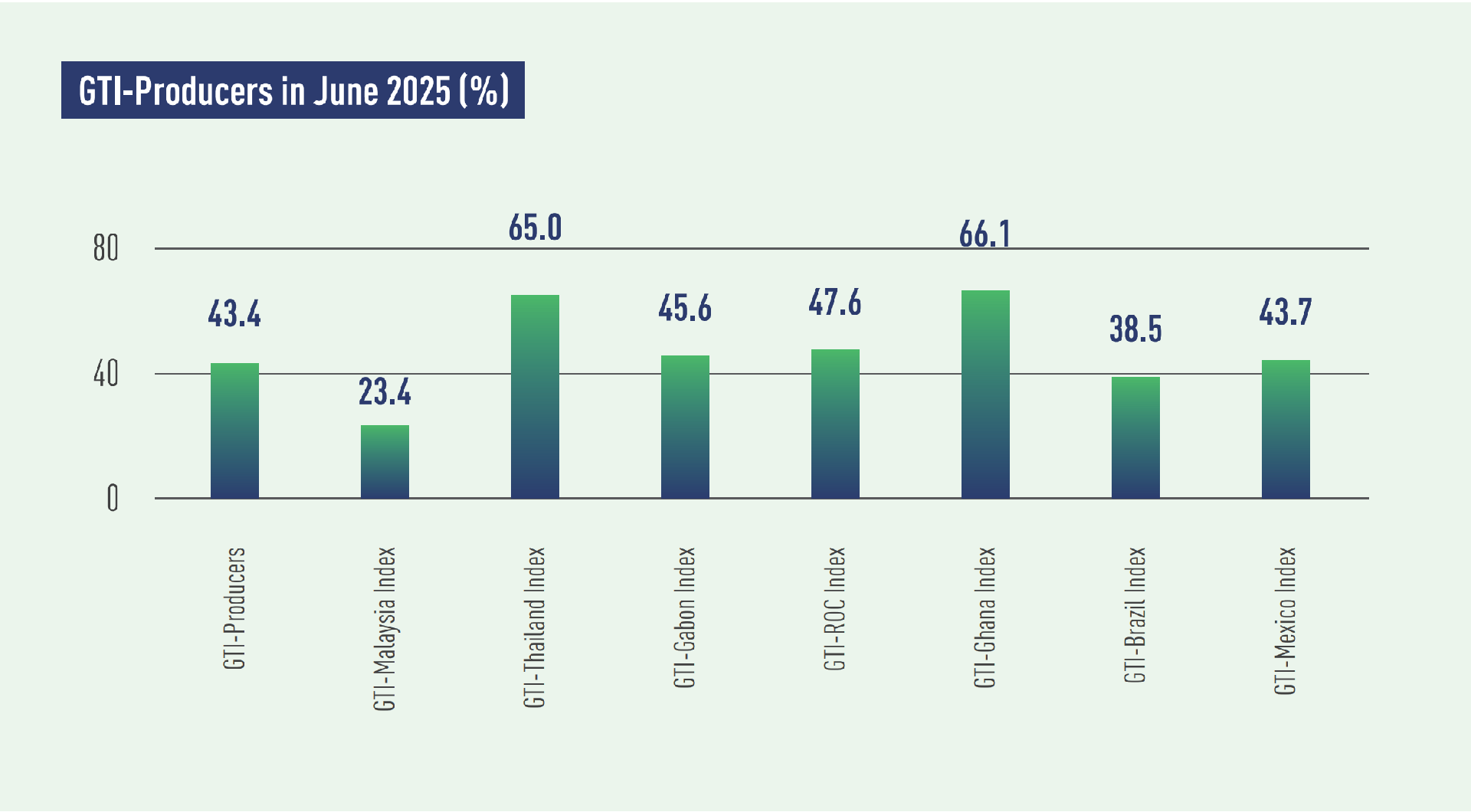

In June 2025, the GTI-Producers registered 43.4% and stayed below the critical value (50%) for the 14th consecutive month, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Among the countries, Thailand's timber sector showed signs of recovery, Ghana had been on an upward trend for several months, while the GTI comprehensive indexes for other countries were still in contraction territory.

In Asia, the GTI for Thailand registered 65.0%, an increase of 18.8 percentage points from the previous month, marking its return above the 50% critical value after five months. The GTI for Malaysia was at 23.4%, continuing to stay in contraction territory for several consecutive months. On the supply side, both harvesting and production volumes in Thailand increased sharply compared to the previous month. In contrast, Malaysia's supply side remained in contraction, although the decline had eased. Currently, Malaysia's timber sector is facing a shortage of log supplies. In response, the government is promoting the cultivation and sustainable management of plantation forests to meet demand while reducing reliance on natural forests. On the demand side, Thailand’ markets, both internationally and domestically, saw significant growth. However, with the arrival of the rainy season in the third quarter, the markets of construction and decorative materials is expected to enter a low season, which may slow down the overall performance in Thailand’s timber market.

In Africa, the GTIs for Ghana, the Republic of the Congo (ROC), and Gabon stood at 66.1%, 47.6%, and 45.6% respectively. Ghana’s timber sector had remained in expansion territory for six consecutive months, while ROC and Gabon remained in contraction. On the supply side, Ghana’s harvesting and production volumes continued their upward trend. However, GTI sample enterprises in Ghana reported several production-related challenges, such as rising electricity tariffs and other production costs. In ROC and Gabon, harvesting volume increased slightly and production remained relatively stable. Overall, the supply-side activities in Africa were more vibrant than in the previous month. On the demand side, Ghana saw a slight increase in new orders, driven by exports. In contrast, both domestic and international orders for Gabon and the ROC continued to decline. In addition to insufficient orders, enterprises in Gabon reported obstacles in market access and slow process of obtaining CITES import permits from Europe, which were further hindering market recovery.

In Latin America, the GTIs for Mexico and Brazil recorded 43.7% and 38.5%, respectively. The GTI for Mexico fell below the 50% critical value after three months of expansion, while Brazil had remained in contraction territory for six consecutive months. This month, Mexico’s harvesting activity stabilized after a sustained expansion. In Brazil, harvesting volume continued to decline due to several factors, such as weak demand, and harvesting difficulties caused by increased rainfall in parts of Minas Gerais and Paraná. Data also indicated a slowdown in timber production activities in both countries. On the demand side, Mexico’s domestic demand grew, while exports saw a sharp decline. In the meantime, Brazil’s domestic and export markets remained sluggish, however, the contraction had eased.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|