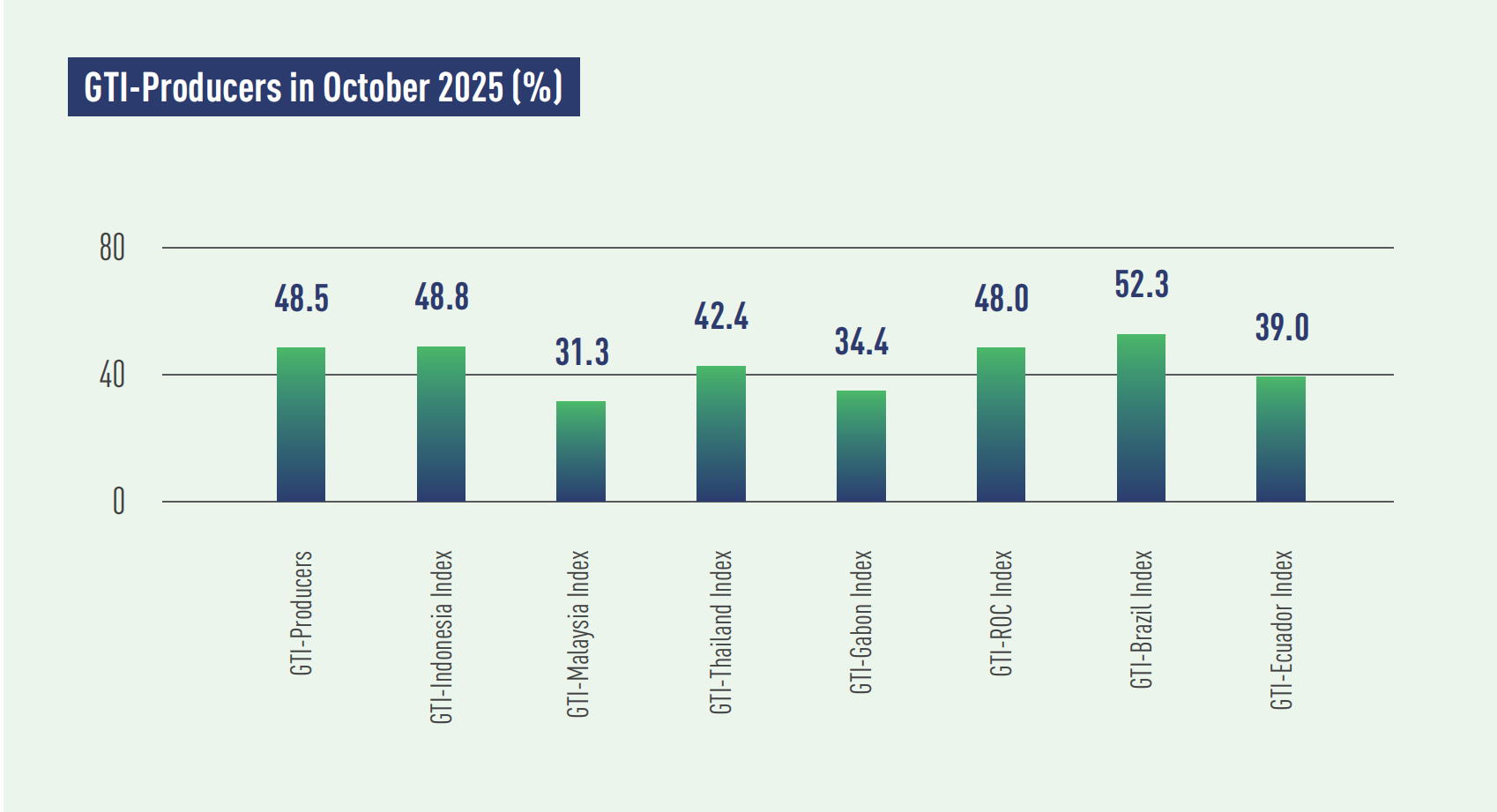

In October 2025, the GTI-Producers registered 48.5% and stayed below the critical value (50%) for several consecutive months, indicating a continued downturn for the timber harvesting and primary processing industries in the pilot producing countries. Brazil's timber industry broke away from the sluggish performance of previous months and showed an overall upward trend.

In Asia, the GTIs for Indonesia, Thailand, and Malaysia stood at 48.8%, and 42.4%, 31.3%, below the critical for all three countries. On the supply side, Indonesia’s production volume has declined for two consecutive months, while harvesting volume has achieved growth for several months. However, enterprises report issues of low log prices and weak log demand. In Malaysia, the downward trend in production has eased, but timber harvesting activities show signs of contraction after last month's recovery. According to feedback from sample enterprises in Malaysia, insufficient raw material supply is attributed to wet weather and changes in government policies. In Thailand, both harvesting and production activities show a downward trend, with domestic shortages of raw materials such as rubberwood. On the demand side, Indonesia's order amount has increased, primarily driven by significant growth in the domestic market. Thailand's overall demand has shifted from growth to a slight decline, while both domestic and international markets in Malaysia remain relatively weak.

In Africa, the GTIs for the Congo, and Gabon were at 48.0% and 34.4%. On the production side, Gabon's harvesting volume has declined for two consecutive months, while production volume remains stable. In the Congo, both harvesting and production volumes remained unchanged from the previous month. On the demand side, Gabon has experienced a reduction in both domestic and international orders. Although the export market in the Congo has slightly contracted, overall market performance remains relatively stable, supported by domestic demand.

In Latin America, the GTIs for Ecuador and Brazil recorded 39.0% and 52.3%, Brazil’s index rose above the critical value, and Ecuadror’s index remained in contraction interval. On the supply side, Brazil's harvesting and production volumes both ended their multi-month downward trend this month, showing an increase compared to the previous month. In contrast, Ecuador's harvesting and production volumes shifted from growth to decline, with domestic issues of insufficient log supply. According to feedback from GTI-Ecuador enterprises, factors such as excessive rainfall, strikes, and equipment shortages have contributed to the decline in log harvesting volumes. On the demand side, Brazil's demand (particularly in the export market) has shown signs of recovery, while market performance in Ecuador remains relatively weak.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|