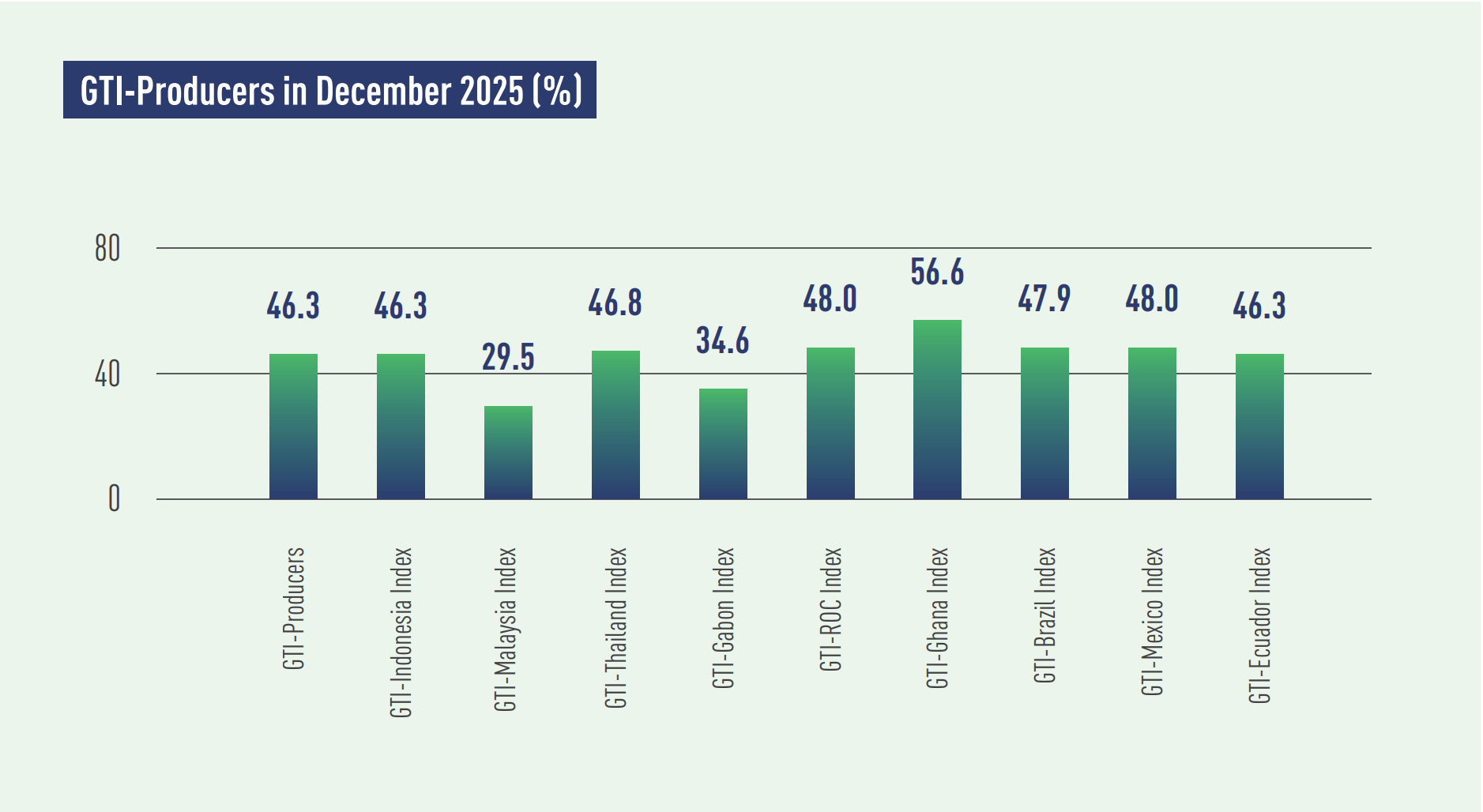

In December 2025, the GTI-Producers registered 46.3% and stayed below the critical value (50%) for several consecutive months, indicating a continued downturn for the timber harvesting and primary processing industries in the pilot producing countries.

In Asia, the GTI readings for Thailand, Indonesia, and Malaysia were 46.8%, 46.3%, and 29.5%, respectively, all in contraction territory below the 50% critical value. Harvesting volumes in these three countries had declined for two or three consecutive months. On the production side, Thailand’s production shifted from stability to a decline, Indonesia’s production fell for the fourth consecutive month, while Malaysia’s production had remained in contraction for a long period. On the demand side, Thailand’s export market grew significantly this month, though domestic demand declined; Indonesia’s export market was generally stable, coupled with a slight increase in domestic orders; meanwhile, both domestic and external demand for Malaysia remained subdued.

In Africa, the GTI readings for Ghana, the Republic of the Congo, and Gabon were 56.6%, 48.0%, and 34.6%, respectively. Overall, Ghana’s timber sector continued to expand, the Congo had maintained in contraction territory for a long period, while Gabon’s timber sector had been in contraction for four consecutive months. On the production side, Ghana’s harvesting and production volumes maintained an upward trend; in the Congo, both harvesting and production volumes shifted from stability to a slight decline; in Gabon, harvesting volume declined for the fourth consecutive month and production volume fell for the second consecutive month. On the demand side, Ghana’s domestic and international markets contracted; the Congo’s export market remained stable for two consecutive months, though domestic demand weakened; Gabon recorded a significant increase in export orders, ending three consecutive months of sharp decline, yet its domestic demand remained sluggish.

In Latin America, the GTI readings for Mexico, Brazil, and Ecuador were 48.0%, 47.9%, and 46.3%, respectively, all below the 50% critical value. On the supply side, Mexico’s harvesting and production volumes had largely trended downward over the past half-year; Brazil’s harvesting and production volumes stabilized after two consecutive months of growth; in Ecuador, production stabilized after two months of decline, while harvesting volume fell for the third consecutive month, with enterprises reporting insufficient log supply and high purchase prices. On the demand side, Mexico saw growth in domestic demand, while its export market remained stable for two consecutive months; Brazil’s domestic demand declined, but its export market had expanded for three consecutive months, supported by proactive market diversification efforts by the government and businesses; however, Ecuador experienced contraction in both domestic and international markets this month.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|