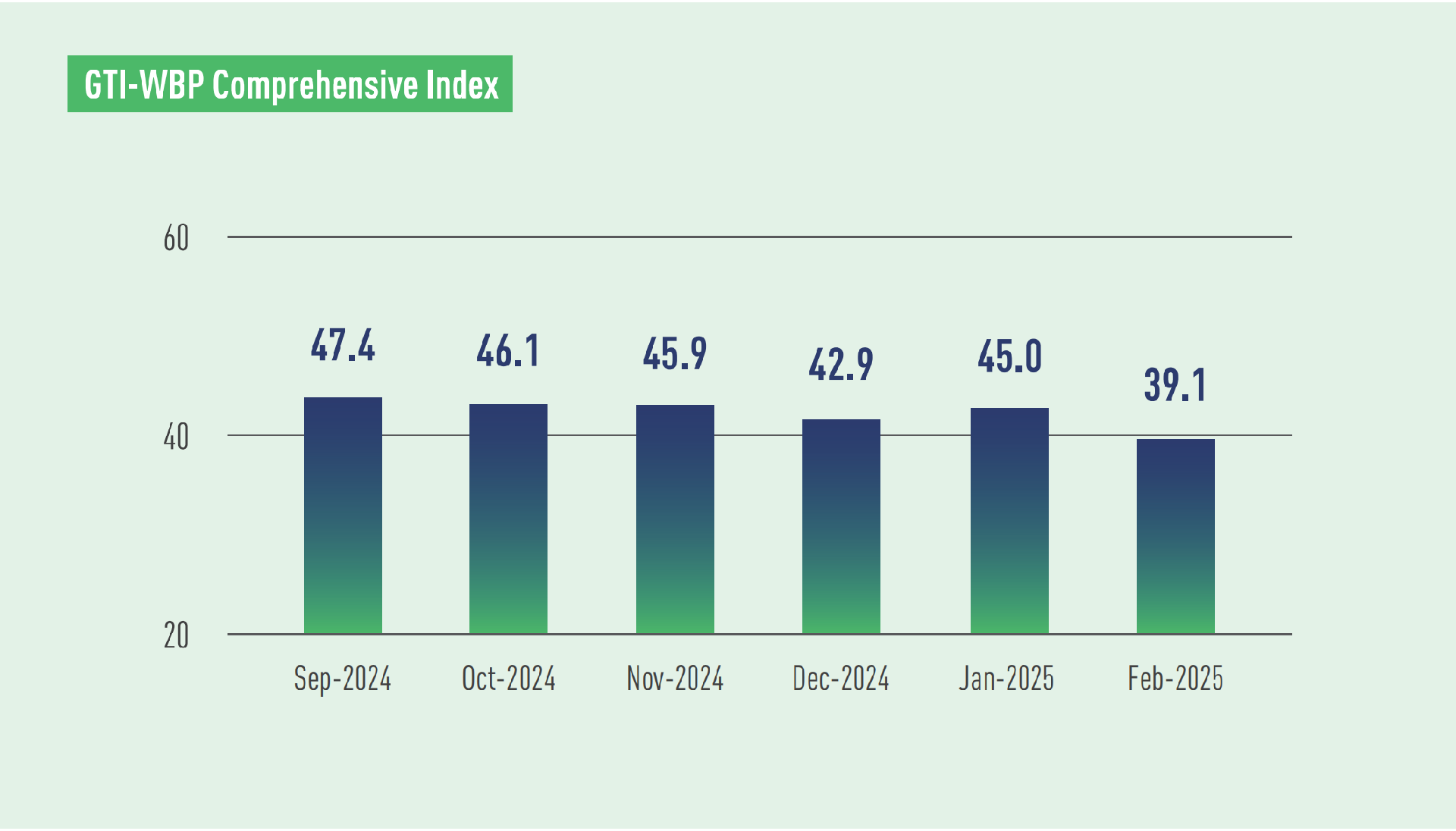

In February 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 39.1%, a decrease of 5.9 percentage points from the previous month, was below the critical value (50%) for eleven consecutive months, indicating that in the GTI pilot countries, the overall business prosperity of wood-based panel industry represented by the index shrank from last month.

On the demand side, the overall demand for wood-based panels in GTI pilot countries continued to decline. This month, the new orders index fell by 9.5 percentage points to 27.5%, the lowest level since records began in April 2024, reflecting a significant reduction in new orders. The export orders index dropped even more sharply, by 15.4 percentage points to 17.1%, suggesting that the degree of contraction in international demand for wood-based panels was much higher compared to the previous month. However, encouragingly, the existing orders index (53.8%) was above the critical value, thus indicating a slight increase in orders on hand and short-term momentum for production.

On the supply side, the supply of wood-based panels in GTI-WBP pilot countries continued to decline for the 11th consecutive month. The production index registered 43.6%, down 5.8 percentage points from the previous month, reflecting a higher degree of contraction. The decline is attributed to several factors, including weak global market demand that reduced companies' production enthusiasm, as well as raw material shortage or rising production costs in some countries, which forced some enterprises to cut or suspend production. Despite the ongoing decline in production, the inventory of finished products increased compared to the previous month.

In terms of prices, the purchase price index for raw materials recorded 68.8%, remaining above the critical value for eight consecutive months, indicating persistently rising raw material costs and great operational pressure. This month, enterprises in Thailand, Brazil, Mexico, and Ghana saw notable increases in the purchase prices of raw materials. In Ghana, in particular, the high costs of electricity, water, and taxes had added to the burden, and sample enterprises in the country called for tax relief and subsidies to alleviate their financial burden. Although the overall purchase price of raw materials for China held steady, some shipping companies announced a new round of price increases for its certain routes in March, increasing cost pressure on Chinese importers. This may may force some raw material importers in the country to adopt a strategy of diversifying their procurement regions in response.

Main updates related to the wood-based panel market include: In 2024, Brazil’s particleboard exports totaled US$113.38 million, representing a 40.4% increase compared to US$80.74 million in 2023. Notably, the exports to China surged by 82.1%. In the same year, Sarawak in Malaysia, saw its plywood export volume rise to 627,389 cubic meters, while the export value fell to about RM1.36 billion. Japan remained the top buyer, accounting for approximately 82 per cent of Sarawak’s total plywood export value last year. However, according to feedback from GTI-Malaysia sample enterprises in February, demand for plywood in the Japanese market had declined.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|