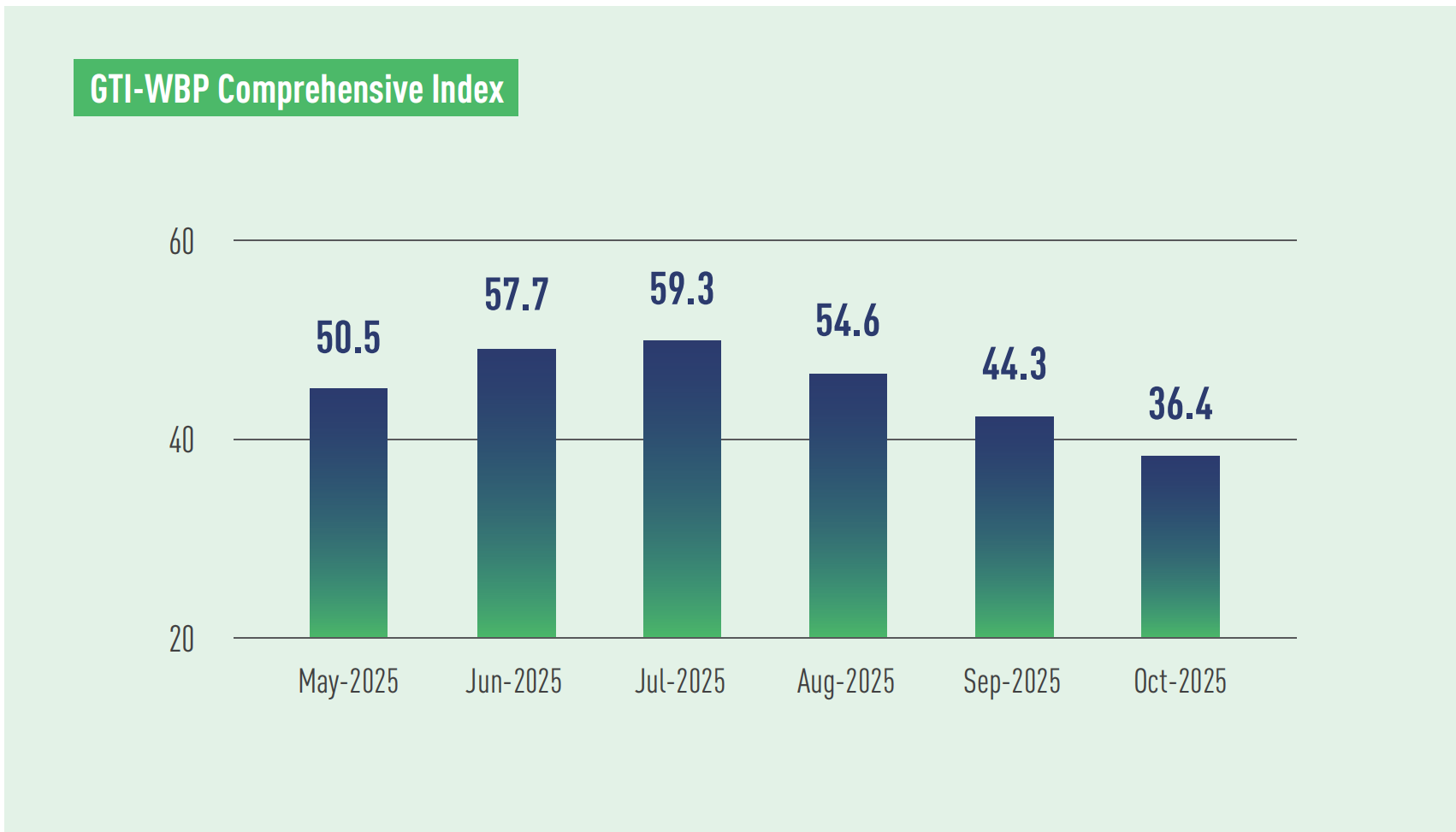

In October 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 36.4%, a decrease of 7.9 percentage points from the previous month and below the critical value (50%) for two continuous months, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index shrank from the previous month.

On the demand side, the overall demand for wood-based panels in the GTI-WBP pilot countries contracted. This month, the new order index was at 36.7%, the export order index stood at 38.0%, and the existing order index registered 35.9%. The real estate markets in countries like China and Thailand were sluggish, leading to a contraction in downstream demand for furniture and interior finishing, which further impacted the wood-based panel market. Additionally, under the influence of U.S. tariff policies, some wood-based panel enterprises had experienced a continuous decline in their market share in North America. Although some enterprises were exploring markets like Europe and Latin America, the incremental gains from these markets were unlikely to fully offset the loss in the traditional market in short term.

On the supply side, the supply of wood-based panels in the pilot countries remained in the contraction territory below 50%. The production index was at 33.9%, a decrease of 7.8 percentage points from the previous month, indicating an overall slowdown in production across the pilot countries. Weak demand had directly impacted the supply side, prompting enterprises to proactively reduce production capacity in response to insufficient orders. Meanwhile, the inventory index of finished products stood at 51.6% and had remained in expansionary territory for the past six months, suggesting a persistent risk of overcapacity in the wood-based panel industry.

In terms of prices, the purchase price index for raw materials recorded 62.9%, remaining above the critical value for the 16th consecutive month, and thus indicating continuous rises in the prices of logs and other production materials. Meanwhile, many enterprises reported declining selling prices of their products. This situation of "rising costs and falling selling prices" was severely eroding their profits, making it difficult to alleviate cost pressures. According to feedback from sample enterprises, wood-based panel manufacturers in many countries needed their governments to introduce tax relief or subsidy policies to help mitigate production and certification costs. Additionally, enterprises were adopting a wait-and-see approach regarding potential increases in international tariffs.

Main updates related to the wood-based panel market include: From January to September 2025, Brazil's total particleboard exports reached US$79.3 million, an 8.8% decrease compared to the same period in 2024. China remained Brazil's largest particleboard export destination, though exports to China fell by 9.3% to US$21.6 million, followed by Colombia, to which exports declined by 1.7% to US$21 million. In other news, experts from Indonesia Eximbank (LPEI) stated that driven by demand from main markets such as the United States, China, and Malaysia, Indonesia's plywood exports are projected to grow by 8% in 2025 compared to the previous year, and this growth trend is expected to continue into 2026, with an estimated increase of around 4%.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|