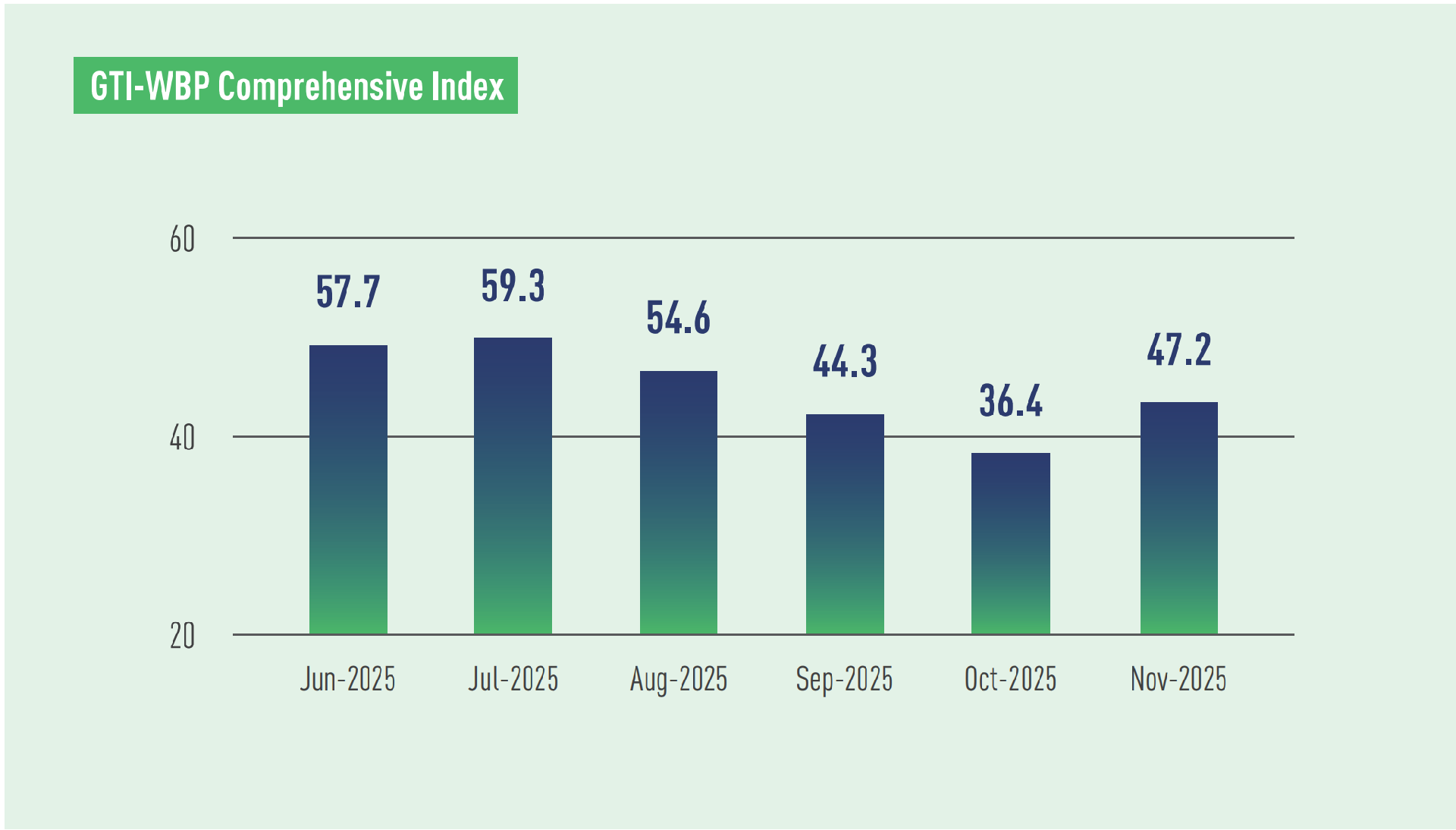

In November 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 47.2%, an increase of 10.8 percentage points from the previous month and below the critical value (50%) for three continuous months, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index shrank from the previous month, however, the contraction had eased.

On the demand side: Overall demand for wood-based panels declines in the GTI- WBP pilot countries. This month, the new orders index recorded 48.4%, and the export orders index registered 43.9%, indicating that the contraction in demand was primarily driven by the export market. Additionally, the existing orders index came in at 38.5%, reflecting a significant reduction in the total volume of orders held by enterprises. Currently, WBP manufacturers in Latin America are among the most affected by U.S. tariff policies—for instance, Brazil's plywood exports have been substantially impacted by the 50% U.S. tariff. Furthermore, non-tariff barriers and the overall downturn in the global real estate market have also contributed to insufficient orders for WBP enterprises in many countries.

On the supply side: The production index for wood-based panels in the pilot countries stood at 44.8% this month, an increase of 10.9 percentage points from the previous month. However, it remained below the 50% threshold for the third consecutive month, indicating a continued decline in total production among sampled enterprises, though the rate of contraction was lower than the previous month. In response to reduced market demand, some wood-based panel manufacturers adjusted their production plans to align with lower order volumes.

From a price perspective: The purchase price index for raw materials recorded 55.2%, remaining above the 50% threshold for the 17th consecutive month, signaling continued upward pressure on prices for logs and other production inputs. For example, log prices rose in countries like Thailand, while China recently experienced a surge in adhesive prices. At the same time, some enterprises were facing persistent declines in the prices of their wood products, compressing profit margins. In this context, businesses were calling on their respective governments to introduce relevant tax incentives or subsidy policies to help alleviate growing operational pressures. Some sampled enterprises also suggested implementing lean production practices to better control operational costs and maintain profitability.

Main updates related to the wood-based panel market include: The European Commission had introduced provisional anti-dumping duties of 5.4% on imports of softwood plywood from Brazil, effective from 5 November. On 20 November, the European Commission announced its definitive anti-dumping ruling on hardwood plywood originating from China, setting a duty of 43.3% for one enterprise and 86.8% for all others, effective from 21 November.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|