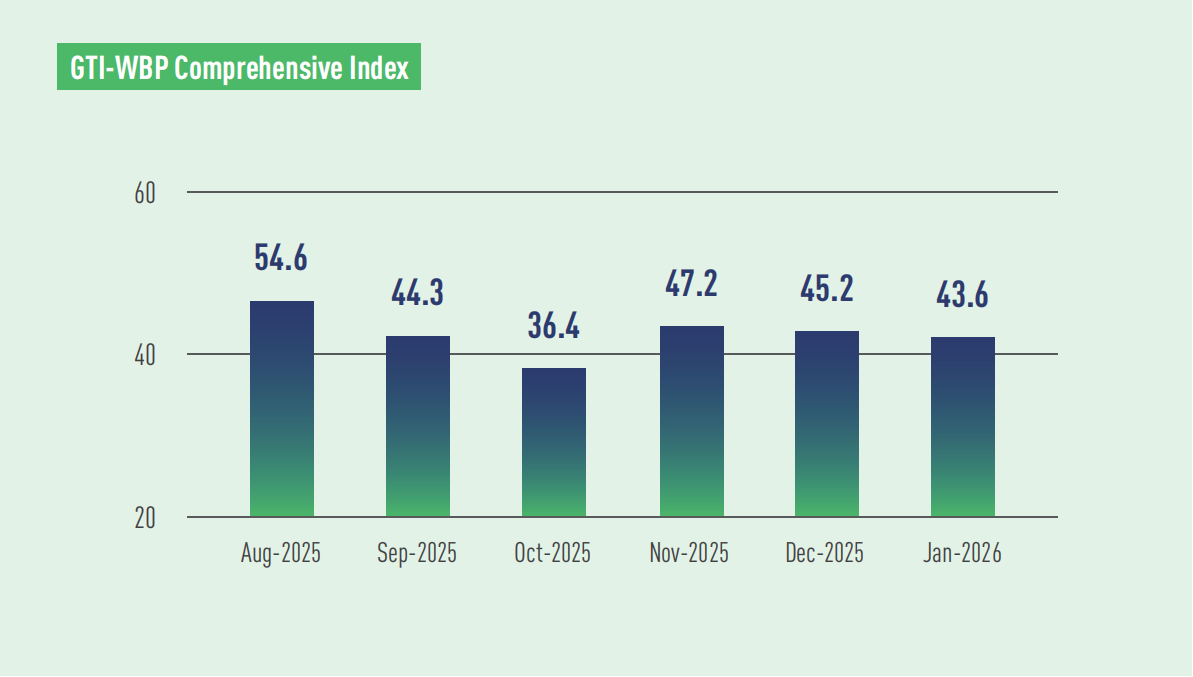

In January 2026, the GTI-Woodbased Panel (GTI-WBP) Index registered 43.6%, a decrease of 1.6 percentage points from the previous month and below the critical value (50%) for five continuous months, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index shrank from the previous month.

On the demand side: Overall demand for wood-based panels continued to decline in the GTI-WBP pilot countries. This month, the new orders index came in at 43.8%, the export orders index at 38.6%, and the existing orders index at 41.1%—all remaining in contraction territory below the 50% critical value. Currently, global real estate markets remain largely sluggish, dampening demand for downstream products such as wood-based panels. Furthermore, during the New Year holiday in January, some enterprises suspended operations, thus seasonal factors also contributed to a decline in market demand.

On the supply side: This month, the production index for wood-based panels stood at 44.8%, up slightly by 0.1 percentage point from the previous month. This marks the fifth consecutive month that the index remained in contraction territory below 50%, indicating an overall decline in production capacity among manufacturers.

From a price perspective: The purchase price index for raw materials stood at 56.3%, remaining above the threshold for several consecutive months. This signals a continued upward trend in the prices of logs and related raw materials, intensifying cost pressures on businesses. In January, sample enterprises in Malaysia, Ghana, and China all reported rising or persistently high raw material procurement prices. According to GTI statistics, businesses in pilot countries such as Brazil and Mexico also continued to face rising input prices. At the same time, limited profit margins—coupled with persistently high operational costs—were placing significant financial strain on enterprises.

Main updates related to the wood-based panel market include: In 2025, China exported a total of around 20.05 million cubic meters of wood-based panel products, representing a year-on-year increase of 12.25%. Imports of such products totaled around 1.36 million cubic meters, down 36.17% year-on-year—marking the first decline in six years. News from the Thai Furniture Association showed that Thailand’s medium-density fiberboard exports reached US$872 million in 2025, up 1.05% year-on-year, while particleboard exports totaled US$478 million, a decrease of 15.86% from the previous year. Meanwhile, the GTI-Indonesia Focal Point reported that in January 2026, Indonesia’s plywood exports fell below the previous month’s level, as buyers in key markets adopted a wait-and-see approach following year-end stock accumulation.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|