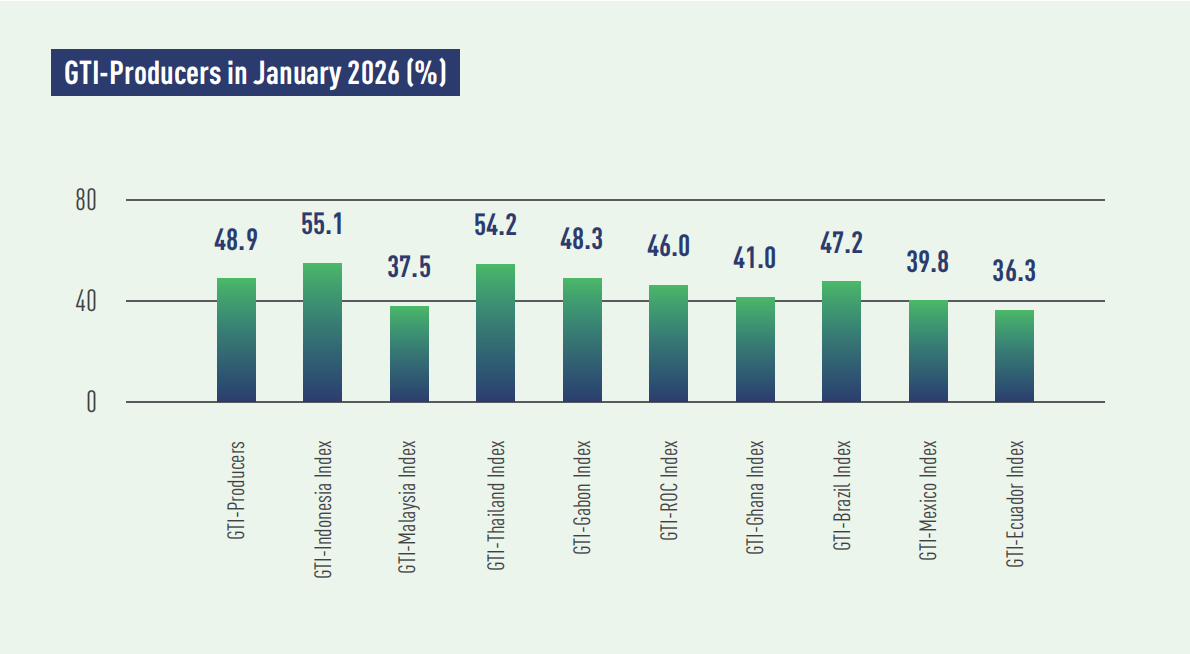

In January 2026, the GTI-Producers registered 48.9% and stayed below the critical value (50%) for several consecutive months, indicating a continued downturn for the timber harvesting and primary processing industries in the pilot producing countries.

In Asia, the GTI indexes for Indonesia, Thailand, and Malaysia came in at 55.1%, 54.2%, and 37.5%, respectively. On the supply side, Indonesia saw a significant uptick in harvesting volume, and production volume rebounded after four months, however, its domestic raw material shortages persisted; in Thailand, the decline in harvesting eased slightly, and production increased compared to the previous month; Malaysia continued to experience declines in both harvesting and production, however, the contraction had eased. On the demand front, domestic orders rose in both Indonesia and Thailand this month, while export orders for both remained largely flat. In contrast, Malaysia continued to face subdued demand in both domestic and international markets.

In Africa, the GTI indexes for Gabon, the Republic of the Congo, and Ghana registered 48.3%, 46.0%, and 41.0%, respectively. On the production side, harvesting and production in both Gabon and the Republic of the Congo held steady from the previous month. Ghana, however, saw declines in both harvesting and production, bringing an end to several consecutive months of growth. In terms of demand, Gabon’s domestic and export orders remained largely unchanged. The Republic of the Congo’s export market stayed stable for the third consecutive month, while domestic orders declined for the second consecutive month. Meanwhile, Ghana experienced continued contraction in both domestic and international orders.

In Latin America, the GTI indexes for Brazil, Mexico, and Ecuador stood at 47.2%, 39.8%, and 36.3%, respectively. On the supply side, Brazil recorded its first decline in harvesting and production in the recent four months. Mexico and Ecuador also saw weaker harvesting and production activities, with both remaining at persistently low levels in recent months. This month, sample enterprises in both countries reported that adverse weather had disrupted production and operations, while Ecuadorian enterprises also cited a shortage of raw materials. On the demand side, despite contractions in domestic markets across all three countries, export markets showed signs of improvement overall. Brazil posted its fourth consecutive month of export order growth; Mexico, after two months of stability, saw a significant surge in export orders; and Ecuador’s export performance remained largely flat compared to the previous month.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|